McGowan will engage the user in a site selection process if the user’s requirement is for a larger capital investment. Usually done on a multi-state basis, this search requires a detailed analysis of costs including transportation, labor, demographics and incentives available on a multi-state basis. McGowan works with the client to develop site selection criteria and brings in relevant partners to complete logistics modeling, facilities strategy, tax scenario planning, incentives and engineering.

Services Include:

Real Estate Portfolio Strategy

The Corporate Real Estate Department makes plans and manages activities that have strategic implications. It makes sense that CRE and the C-suite would collaborate to maximize corporate flexibility. Much like the finance function, if CRE lacks input into corporate strategy development, the strategy could be expensive and slow to implement, not to mention limited in the extent of its potential benefit to the shareholders. As an independent advisor, McGowan helps tenants develop and refine strategic, financial and operational real estate requirements. What makes us unique is that we can deliver the corporate services required to complete a requirement but we also understand how capital drives the equation for the landlord and tenant. Whether we are providing users with advice on acquisitions, disposals, renewals, relocations, consolidations, or capital, our detailed knowledge of real estate and capital markets, combined with strategic problem-solving abilities create meaningful solutions for our clients.

Our multi-step process will improve your operating margins through more efficient administration and management of your real estate portfolio.

Please contact us if we can help you identify and quantify savings opportunities within the portfolio.

How is your portfolio of properties administered and managed? What type of database houses your real estate portfolio information? How are critical dates disseminated to key personnel? How are new real estate projects launched and tracked? How are changes to the portfolio tracked and measured over time? What Key Performance Indicators (KPI’s) are utilized? (costs, headcount per square foot, etc.)

Abstract lease documents in uniform and consistent fashion - lease terms, options, payments and critical dates Produce standard reports including space, cost, options, expiration dates, escalations, lease type and reimbursement method Report identifying future liabilities, risks Provide easily accessible real estate database and document repository (web‑based)

“Pay Rate” is contract lease rent plus accumulated operating expenses and utility costs Benchmark Analysis – How does each location’s current rent (adjusted) compare to the current market? Analyze landlord operating expense bills (including utilities and reconciliation statements) and compare to market

Identify core and non-core locations Identify consolidation, expansion and contraction (rooftop reduction) opportunities Review business acquisitions and planned dispositions Blend and extend opportunities based on market conditions Benchmark and performance review – KPI’s vs. your industry peer group information

Review headcount and capacity information for each facility Measure headcount per square foot vs. industry standards Space design - develop space and density improvement strategies (i.e. layout and furniture standards) Financial and strategic impact of each project

How will your existing locations and obligations be impacted by new FASB / IASB accounting guidelines? Planning for balance sheet impact of new (and renewal) real estate transactions

FINAL STEP Provide a Summary of Your Real Estate Portfolio Information and Recommendations

Optimal Warehouse Network Configuration

From Chicago Consulting, below is an evaluation of the 10 Best Warehouse Networks based on number of distribution of DCs with the lowest possible transit lead-times to customers represented by the US population. For example, Vincennes, IN provides the lowest possible lead-time for one warehouse. Any other place will increase transit lead-time to the US population. Similarly putting any three warehouses in any locations other than Boyertown PA; Jackson TN and Porterville CA will cause the transit lead time to be higher than 1.33 days.

| NUMBER OF WAREHOUSES IN THE NETWORK | AVERAGE DISTANCE TO CUSTOMERS (Miles) | AVERAGE LEAD TIME TO CUSTOMERS (Days) | BEST WAREHOUSE LOCATIONS | ||

| One | 819 | 2.31 | Vincennes IN (100) | ||

| Two | 506 | 1.53 | Ashland KY (76) | Porterville CA (24) | |

| Three | 398 | 1.33 | Boyertown PA (33) | Jackson TN (44) | Porterville CA (23) |

| Four | 337 | 1.24 | Lansdale PA (28) | Meridian MS (27) | Chicago IL (22) |

| Porterville CA (23) | |||||

| Five | 279 | 1.15 | Brooklyn NY (22) | Statesboro GA (19) | Chicago IL (22) |

| Grand Prairie TX (16) | Porterville CA (21) | ||||

| Six | 250 | 1.11 | Brooklyn NY (22) | Statesboro GA (19) | Chicago IL (22) |

| Grand Prairie TX (16) | Bell Gardens CA (16) | Bonney Lake WA (5) | |||

| Seven | 227 | 1.1 | Brooklyn NY (22) | Athens GA (14) | Palm Bay FL (7) |

| Chicago IL (21) | Grand Prairie TX (15) | Bell Gardens CA (16) | |||

| Bonney Lake WA (5) | |||||

| Eight | 211 | 1.07 | Brooklyn NY (22) | Grand Prairie TX (15) | Bell Gardens CA (16) |

| Chicago IL (20) | Palestine TX (12) | Aurora CO (5) | |||

| Bell Gardens CA (15) | Bonney Lake WA (5) | ||||

| Nine | 198 | 1.04 | Brooklyn NY (22) | Aiken SC (14) | Lakeland FL (6) |

| Chicago IL (20) | Palestine TX (12) | Denver CO (5) | |||

| Bell Gardens CA (15) | Bonney Lake WA (5) | San Juan PR (1) | |||

| Ten | 184 | 1.04 | Brooklyn NY (22) | Aiken SC (14) | Lakeland FL (6) |

| Chicago IL (20) | Palestine TX (12) | Denver CO (5) | |||

| Pasadena CA (10) | Bonney Lake WA (5) | Oakland CA (5) | |||

| San Juan PR (1) | |||||

| From Chicago Consulting – Supply Chain Consultants | |||||

Corporate Real Estate Services

The Corporate Real Estate Department makes plans and manages activities that have strategic implications. It makes sense that CRE and the C-suite would collaborate to maximize corporate flexibility. Much like the finance function, if CRE lacks input into corporate strategy development, the strategy could be expensive and slow to implement, not to mention limited in the extent of its potential benefit to the shareholders. McGowan is an independent, unbiased advisor. We help tenants develop and refine strategic, financial and operational real estate requirements. What makes us unique is that we can deliver the corporate services required to complete a requirement but we also understand how capital drives the equation for the landlord and tenant. Whether we are providing users with advice on acquisitions, disposals, renewals, relocations, consolidations, or capital, our detailed knowledge of real estate and capital markets, combined with strategic problem-solving abilities create meaningful solutions for our clients.

Requirement Development

Lease Abstraction

Creation of an abstract report of your leases with a summary of financial and legal lease terms including amendments, exhibits, and schedules.

Lease Administration

Cloud based comprehensive, powerful and easy-to-use real estate and lease management software solution that makes it easy to know what your leases say, how much they cost, and when they need attention. It enables companies to control, report, track, and manage owned and leased real estate and make better decisions on leases and related information.

Lease Audits

Real Estate Portfolio Management

Industrial Land

McGowan is an industry expert when it comes to complex land transactions. Whether it is raw land or the acquisition of parcels within a subdivision, McGowan has completed a variety of projects including the largest industrial land deals in two states, Idaho (87 acres for cold storage facility for a grocer) and West Virginia (400 acres for a chemical plant). Both sales were multi-year processes involving the project management of engineering and significant offsite improvements including roads, rail, and utilities. In addition, this process included dealing with state agencies for incentives and cultural artifact analysis.

McGowan has also been involved in repurposing environmentally challenged sites working closely with environmental consultants, EPA, and state regulators to repurpose land for development.

McGowan will run a land search in secrecy for the client and will deal directly as the company representative with the landowners and the top levels of government.

Services Offered:

Click here for a free evaluation market survey of options.

Real Estate Land Development Process

Office Space Calculator

Please contact us if you are interested in learning more about a sale-leaseback.

Capital

McGowan works with clients to finance direct private placements and joint-ventures. Without the proper capital stack, a deal (purchase, lease, tenant improvements) may not be able to be completed. McGowan has a network of debt (CMBS and balance sheet) and equity capital sources. McGowan can arrange a full suite of loan programs on a broad range of commercial property types including permanent, construction/interim, B-note/mezzanine and other capital solutions.

Debt (CMBS or Balance Sheet)

Checklist for Quote Submissions. Click here to contact us for a free quote

Forward Sales Of Build To Suits for Owner Users

If an industrial user with good credit would like a facility constructed for a long term lease but does not want to be an owner, McGowan can arrange a developer to build the building and an investor to buy the net leased asset. A net lease where all property operating expenses, such as insurance, real estate taxes, utilities, maintenance and repairs paid by a tenants, is very valuable to a net lease buyer. McGowan can arrange a full slate of innovative commercial financing options for investors and owners users.

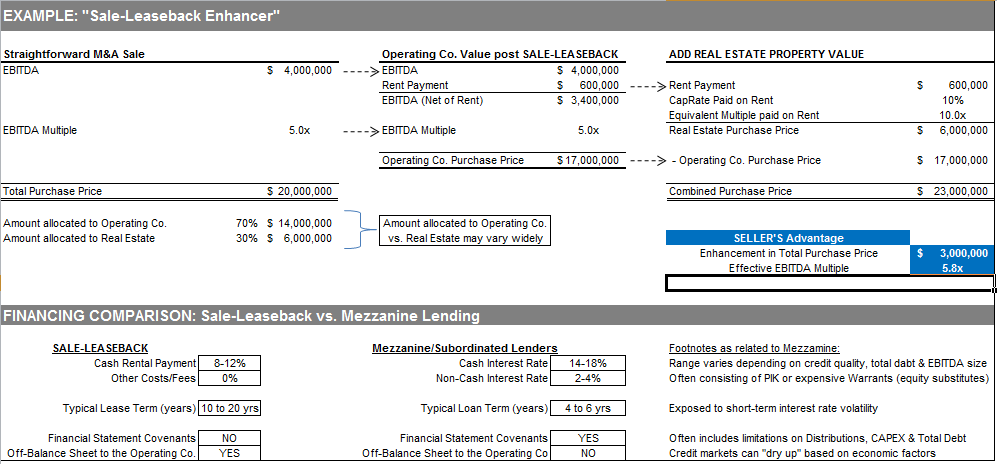

Sale Leaseback

Sale Leaseback Structuring

McGowan can structure and place sale/leasebacks and other financial vehicles for corporate users looking to sign long term leases and remove the real estate from the balance sheet. There is a healthy investor market for long term single tenant NNN leases and users are often able to quickly liquidate their real estate without moving.

Sale Leaseback Advantages to Tenant

Due Diligence Process

Innovative Financing For:

Please contact us if you are interested in learning more about a sale-leaseback.

Broker Referrals

McGowan is a Broker of Record in Pennsylvania, New Jersey, Delaware, New York, Maryland, West Virginia, Virginia, Massachusetts, Idaho, Utah, and Maine.

Our Expertise

When referring business to another market where local expertise is needed, McGowan handpicks the best provider. This provider may be from the largest firm or a small independent firm. Simply put, we make sure our client gets the best service and manage the process along the way. McGowan knows how hard a broker works to secure their client. These relationships can take years to develop. When a broker looks to complete a mission critical requirement or even a smaller deal in another market, they need a provider who will show all available options and is totally focused on their client's success. The receiving broker of a referral needs to treat an inbound referral with extra care. In addition, the receiving broker needs to respect the referring broker's relationship. Finally, the receiving broker must make sure that the referring broker is paid promptly. McGowan refers business around the country so whether as a sender or receiver of a referral, McGowan looks to cooperate with brokers. In addition, McGowan was the (founder of the SIOR Independent Broker Group) so he inherently understands the value of other brokers and their clients.

Contact us if you are thinking about referring your client for an requirement in Eastern PA, New Jersey or Delaware.

Benefit To A Client

The all-star brokers in every market simply do not all work for the same company. Brokerage is unique as a business when compared to other professional services such a accounting, law, or consulting that set up national firms. Given the nature of the independent nature of real estate brokers, a national brokerage firm simply can not produce a uniform culture, hiring practices or training to guarantee service delivery. All of the larger firms have grown by acquisition and most brokers are independent contractors at least by tax status or most certainly by personality. McGowan handpicks the best team for each project with a roster of all stars. When dealing with a national brokerage firm, that firm will require that deals in Michigan or Dallas are handled by brokers within their network. So you might get the junior guy in Michigan who is trying out brokerage for the year. In addition, national brokerage firms are set up so that the agent who secures the national account often times does not leave much in the deal for the local broker. McGowan picks the best broker in the region and makes sure that broker is paid for his services so that he wants to work on the deal and the client gets the best service.

McGowan picks the best broker in the region and makes sure that broker is paid for his services so that he wants to work on the deal and the client gets the best service.

McGowan is a Broker of Record in Pennsylvania, New Jersey, Delaware, New York, Maryland, West Virginia, Virginia, Massachusetts, Idaho, Utah, and Maine.

Listings

3450 Highpoint Blvd, Bethlehem, PA 18017

1685 Valley Center Parkway, Bethlehem, PA 18017

Please contact us for information or a tour of our listings.