Private Equity – M&A Advisory

For buyers of companies in a world awash in capital, the prices of target deals are often bid up. Buyers need to examine the real estate portfolio of any potential acquisition as a way to improve profitability and pay down purchase equity. Real estate is the largest off-balance sheet liability but historically, private equity firms have focused their cost cutting on labor expenses or the cost of goods. However, the most savvy private equity players realize that lease obligations in many cases are a greater amount than loan liabilities thus of great importance.

It is not uncommon for companies to undervalue their real estate in regulatory filings, so there is the possibility that real estate assets could be worth more. The differential in valuation often attracts activist investors who claim that a company's real estate is worth more than what filings indicate.

The best performing PE firms look at opportunities to quickly monetize real estate assets through a REIT offerings or a sale-leasebacks to recover whatever equity has been invested. McGowan is a trusted advisor in this space.

McGowan serves as a powerful advisor to help a private equity investor avoid overpaying for an acquisition. By analyzing the lease obligations and owned assets, buyers may find reasons to discount a deal or, alternatively, raise the offer. McGowan excels at structuring scenarios where properties are liquidated in concert with their strategic importance.

Mergers and Acquisitions

McGowan provides strategic real estate advisory services to facilitate corporate change. As part of the process, we specialize in asset componentization of nonstrategic real estate. This materializes in partnerships in which McGowan acts as a co-investor or as an agent, offering brokerage services and auctions for the sale/leaseback of core properties, sale of nonessential owned or leased properties.

McGowan can partner with clients as they value and acquire businesses, maximizing the value of new locations, and assisting in the work and expense of disposing unwanted assets. We have deep experience in lease restructuring to minimize liabilities and maximize value in connection with core leased locations.

McGowan can provide or arrange the capital necessary to purchase unwanted or duplicative assets (for example, going-concern divisions, real estate, excess and obsolete inventory, FF&E, etc.). The client takes only the locations and related assets it wants, thereby reducing acquisition costs and streamlining its balance sheet. The client’s management can focus on the go-forward business, while McGowan handles the disposition of unwanted and duplicative assets.

We offer the experience to successfully handle all situations, and we integrate seamlessly with your operations, real estate, and legal staff. McGowan can facilitate your M&A transaction by reducing equity requirements and handling the real estate repositioning and/or disposition process.

E-Commerce - Retail - Last Mile

Consumers have more choices than ever when interacting with a retailer. They buy online and attempt to return inventory to the store. Smartphones and tablets are creating a disruptions in the supply chain and the facilities required to meet this OMNI-CHANNEL demand are also evolving. Making this highwire act that retailers are attempting even more difficult, customers armed with smartphones and take to Twitter and Facebook and berate retailers that fail to deliver customer service. In addition customers "showroom" and wring better prices out of retailers as every purchase competes against Amazon.

An e-commerce facility is increasing automated and one developer described the latest version of e-commerce distribution facilities as a "machine with a lid on top" when a user asked for a triple layer conveyor on top of a mezzanine. Parking requirements are growing, clear heights and thus cubic storage is growing, trailer storage and power requirements are growing. Cross dock facilities are being reconsidered for single side loading buildings as e-commerce users need the parking on the backside of the building for employees and trailers.

Distribution centers must always be on the cutting edge with the latest innovations in transportation, automation, and distribution. Many of the current facilities on the market that have been built by the development community are outdated. How will 3D Manufacturing impact your supply chain? Should a retailer leveraging its retail store network to "click and collect"?

Last Mile

Last mile facilities are key to offer quicker e-commerce service to urban users. McGowan has worked on site selection as well having successfully marketed facilities and locations that are near large city populations. While these facilities are often older, they often involve a retrofit, demolition, and/or dealing with legacy environmental issues. McGowan has successful worked on a number of very complicated environmental sites.

RILA

To keep up with the latest trends in retail supply chain, McGowan has attended RILA's Retail Supply Chain Conference where all of the major retailers discuss both their shared and unique challenges.

ICSC

Are you in danger of being "Amazoned"? Developers are reporting that the first round of Distribution Centers built by Amazon are already obsolete and their new DCs.

Click here to for a free introductory analysis of your facility network to see if you are up to the e-commerce supply chain challenge.

Cold Storage – Food – Beverage

What we do know now is the expansion of cold storage is supported by the uniqueness of the frozen food industry in that it benefits from being rather inelastic as the demand for food remains steady regardless of economic conditions. For example, during the 2008 recession, restaurant visits dropped dramatically while demand for frozen food products increased. The steady demand through various economic cycles mitigates the potential risks to owning and operating cold storage facilities.

Another secular trend is the share of products stored in refrigerated warehouses that are imported from abroad and also destined for export to other countries. This has led to higher trade volume, bolstering demand for cold storage facilities in coastal markets with access to ports. According to the USDA and as one example, fresh produce imports are projected to rise by 45% from 2016 to 2027. These increases in fresh and frozen foods is supported by a 2016 study conducted by Capgemini Consulting, indicating 73 percent of U.S. shipping and transportation companies expected to increase their use of outsourced logistics services in the coming years.

These growth trends have resulted in a recent industry report that confirmed the massive need for additional cold storage refrigerated space. However despite the demand projected for cold storage, given the high cost of construction, projects fail to get off the ground because speculative construction is beyond the risk profile of the vast majority of investors. By combining market research, customer acquisition assistance and real estate brokerage, we can ensure that this project is not just built, but is optimally configured for success.

The proliferation of food and beverage choices demanded by consumers impact the global cold chain. Users demand facilities that have dry food, cooler, refrigeration, and freezer capabilities. Often the energy bills on temperature controlled facilities dramatically drive up costs. In addition, users have to comply with USDA and other regulations. Food and Beverage Users face added challenges with perishable inventory risks. New innovations in temperature controlled containers are giving food companies new opportunities to save on transportation costs. User requirements vary from small local producers to global food manufacturers and their facilities include poultry plants, produce facilities, industrial kitchens, bakeries, meat plants, food service facilities, dairy plants, cheese plants, and distribution centers.

As food and beverage facilities are specialized, oftentimes, users engage in build to suit transactions or look to 3PLs to manage their cold chain.

Services

Click Here For An Evaluation Of Your Cold Chain Real Estate Needs.

Manufacturing

Manufacturers today must make strategic decisions in a landscape accounting for:

The most innovative manufacturers will take advantage of new opportunities to advance their digital strategy.

Over the last few decades many manufacturers have pursued outsourcing strategies. In many cases financial benefit to their investors (public and private) was the key driver. Many are now starting to see the limits to the benefit of outsourcing. Specifically, moving production overseas might no longer save money and re-shoring facilities is occurring more frequently. In some cases, nearshoring in Mexico is an option. As manufacturers look to re-shore, they face an inventory of facilities that may not be up to their standards.

McGowan was SIOR's representing member on the SIOR/IAMC Industrial Facility Flexibility Research committee. This group worked to evaluate the state of industrial real estate relative to the flexibility and reuse potential of warehouse, distribution center, research, laboratory, chemicals and gases manufacturing, heavy and light manufacturing, and regulated manufacturing (which includes pharmaceuticals and food). Of the challenges to flexibility, the project evaluated those due to work process, infrastructure (including HR and technology) and the facility itself, among others.

As labor costs rise and margins are near their peak, siting a manufacturing in a tax advantageous, business friendly location is of vital importance. While rent is important, transportation costs are far and away the largest driver.

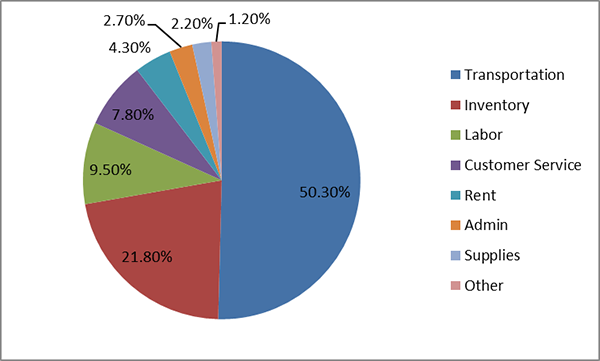

Sample cost model of a manufacturer where rent is only 4.3% of total cost versus 50% for transportation. Locating near intermodal due to the shortage of truck drivers is a key consideration for flexibility.

Top 10 Site Selection Criteria for Manufacturers are:

Services

Click here for a free evaluation of your manufacturing facility options.

Energy

The Marcellus Shale is buried thousands of feet beneath the earth’s surface. This deposit extends from upstate New York south through Pennsylvania to West Virginia and the western parts of Ohio. The Marcellus Shale formation is rich in potential energy plays.

McGowan managed the site selection and land acquisition for a large petrochemical company that recently announced it was building a cracker. This was one of the largest projects in the Marcellus Shale region. A "cracker" is industry lingo for a plant that converts ethane, a byproduct from the Marcellus Shale into ethylene which is a component of plastic. With the fracking of the shale, there is a surplus of ethane in Appalachia and thus substantial economic activity in this sector.

Users that buy land in the Marcellus Shale region must make sure that soils are evaluated properly and that all regulations are followed so that extraction is done safely.

Services

Greater Philadelphia: The Next Energy Hub

Click here for a free evaluation market survey of options.

Energy

The Marcellus Shale is buried thousands of feet beneath the earth’s surface. This deposit extends from upstate New York south through Pennsylvania to West Virginia and the western parts of Ohio. The Marcellus Shale formation is rich in potential energy plays.

McGowan managed the site selection and land acquisition for a large petrochemical company that recently announced it was building a cracker. This was one of the largest projects in the Marcellus Shale region. A "cracker" is industry lingo for a plant that converts ethane, a byproduct from the Marcellus Shale into ethylene which is a component of plastic. With the fracking of the shale, there is a surplus of ethane in Appalachia and thus substantial economic activity in this sector.

Users that buy land in the Marcellus Shale region must make sure that soils are evaluated properly and that all regulations are followed so that extraction is done safely.

Click here for a free evaluation market survey of options.

Data Centers

With a background in IT consulting at Price Waterhouse and deep expertise in industrial real estate brokerage, we bring a unique skill set to the evolving data center market. Our approach integrates technical, operational, and financial considerations, ensuring businesses make informed, strategic decisions about their digital infrastructure.

• Land Acquisition & Development Consulting

With expertise in both IT strategy and industrial brokerage, we help clients select and acquire prime locations for data center development—focusing on power availability, fiber connectivity, and economic incentives.

• Sale-Leaseback Advisory

We help enterprises unlock capital while maintaining operational control by structuring sale-leaseback transactions, ensuring financial flexibility and long-term sustainability.

• Colocation & Wholesale Data Center Advisory

We guide enterprises, cloud providers, and hyperscalers in identifying and securing colocation, powered shell, and wholesale data center solutions that align with their IT and operational requirements.

• Investment & Capital Markets Guidance

Leveraging our network and industry insights, we assist REITs, private equity firms, and institutional investors in evaluating, acquiring, and divesting data center assets.

• Tax Incentive & Economic Development Advisory

We help clients navigate the complex landscape of tax incentives to maximize savings and enhance the financial viability of their data center operations.

Completed Deals

McGowan has completed leases, sales, investment sales, financings (equity and debt), sale-leasebacks, (partial list) at the following properties for a variety of food, e-commerce, manufacturing and other users. These facilities which include warehouses, distribution centers, manufacturing, flex buildings, cold storage, industrial land and chemical plants. Click on the photo of the building to see a Google Earth Image.

Lehigh Valley Industrial Park 3

Liberty Business Center II

Humboldt Industrial Park

Wincester Plaza

Lehigh Valley Corporate Center

Raritan Center

Marsh Creek Corporate Center

55 & 75 East Uwchlan Avenue

Exton, PA 19341

Building Size: 92,000 SF

Plymouth Meeting Executive Campus

Spanish Springs Corporate Park

East Mountain Corporate Center

Brunswick Distribution Center

60 Brunswick Ave.

Edison, NJ

Building Size 152,000 SF

Saw Mill Park

670 Bellevue Turnpike

Kearny, NJ 07032

Building Size: 211,418 SF

Berkeley Business Park

5550 Winchester Ave.

Martinsburg, WV 25405

Building Size 389,244 SF

Lehigh Valley Corporate Center

Hanover Business Center East

Former First Niagara Bank Branch

One Metro Center

Crown Pointe Corporate Center

Delta Pointe at Silver Spring

Hamilton Business Center

Alovats North

One Costco Way

Monroe, NJ 08831

Middlesex County - Exit 8A

Building Size: 983,320 SF

Iron Run Corporate Center

7132 Daniels Dr.

Allentown, PA 18106

Lehigh County

Building Size: 289,900 SF

Cindel Business Park

2900 Cindel Dr.

Cinnaminson, NJ 08077

Burlington County

Building Size: 465,000 SF

Conewago Industrial Park

11 Industrial Rd.

Elizabethtown, PA 17022

Lancaster County

Building Size: 210,000 SF

Hanover Industrial Estates

135-165 Stewart Rd.

Wilkes Barre, PA 18706

Luzerne County

Building Size: 83,025 SF

The Chester Creek Business Center

120 Concord Rd.

Aston, PA 19014

Delaware County

Building Size: 57,600 SF

Naamans Creek Bus Center

4 Creek Pky.

Boothwyn, PA 19061

Delaware County

Building Size: 32,000 SF

Harrisburg Warehouse

431 Railroad Ave

Camp Hill, PA 17011

Cumberland County

Building Size: 332,170 SF

1700 Conrad Weiser Pky

Womelsdorf

Berks County, PA 19567

Building Size: 190,000 SF

Includes Roof Lift - click for details

Winco Food Distribution Center

2390 E Freight Rd

Boise, ID 83716

Building Size: 800,000 SF

Petrochemical Complex - Ethane Cracker

Parkersburg, WV

400 Acres

Reno Industrial Lease

4945 Aircenter Circle

Reno, NV 89502

Building Size: 124,500 SF

Cedar Crest Professional Park

Plygem Siding Group

Spartanburg, SC Distribution Center

Pulltarps Manufacturing

Centre Point

Bainbridge Warehouse

Valley Forge Square 2

Los Angeles Warehouse

Inland Empire East Warehouse

Lehigh Valley Industrial Park IV

BB&T Bank Building

Central Crossings Business Park

Penn Corporate Center

Radnor Financial Center

Exton Office

West Philadelphia Last Mile Warehouse

Burtonsville Commerce Center

Moorefield VI Building

Central New York Warehouse

New Jersey Warehouse

Middletown Commons

Northeast Philadelphia Warehouse

Bethlehem Pike Industrial Center

York Warehouse

The Frederick Building

Lehigh Valley Corporate Center

Reno Airport Warehouse

Exit 8A Warehouse

Parkersburg, WV Warehouse

374 Acre Site Vetted for Ethane Cracker

Over a period of roughly ten years, McGowan represented the assemblage, purchase and disposal of a 374 acre site vetted for an Ethane Cracker in Washington, WV. This assignment required managing many constituencies including the owner, multiple buyers and sellers as well as the state and local economic development entities as well as utilities and service providers.

Attached is a teaser flyer that was produced for the 374+/- Acre site located on the Ohio River in Washington, WV. This unique site was ready for development and came with strong environmental protections. Located in the heart of the Marcellus Shale Region, this rare flat site was CSX rail served with Ohio River barge access. This was a prime location for the next mega-project in the region.